Employers urged to prepare for combined employer return

Revenue Jersey is reminding employers – including building contractors – to prepare for changes to the way they submit their returns of employees’ tax deductions, taxable benefits, contributions and manpower.

Under the current system employers submit their tax, social security, and manpower information on different returns.

From January 2022, employers will submit a Combined Employer Return (CER) every month, which will include tax, social security contributions and manpower all on the same return.

The deadline for the first return under the new system is 15 February 2022.

To complete the CER, employers who use their own payroll software will need to make changes to their systems. Employers who use the online employer returns form will be redirected to a new form when they submit their January 2022 return.

Submissions will need to include the correct social security numbers and tax identification numbers for each of their employees, to be accepted. Ahead of the change, employers will need to ensure all their records are correct and up to date.

Comptroller of Revenue, Richard Summersgill, said: “This initiative will make life easier for employers, enabling them to tell Government about a number of employee-related matters just once. It is the latest step in the Government’s plans to collect revenues more efficiently by centralising services and systems where it is appropriate to do so.”

“We’re committed to achieving this by modernising our legislation, providing easier access to services online, ensuring all customers can understand and meet their obligations while reducing costs.”

“The new return will make the submission process easier for employers but it’s important that employers are sufficiently prepared by having the correct information for their employees. We have been updating employers for some time and there is detailed information and advice on how to prepare for the changes on a dedicated webpage.”

More information about changes is available via the Government of Jersey website: www.gov.je/CombinedEmployerReturn

Payroll suppliers and employers have received information about the changes to give them enough time to update their systems and software.

Employers can also request IT specifications for their payroll provider, or subscribe to regular email updates by emailing: cer@gov.je

Source: Government of Jersey News Release.

September 18, 2024

Related articles

December labour market report published by Statistics Jersey

Statistics Jersey have today published the December 2020 Labour Market report. Jersey’s labour market report is published every six months and covers key aspects of the job market for both the private and public sector.

In December 2020:

-

the total number of jobs was 60,000. There was an annual decrease of 1,380 jobs (2.2%) since December 2019, the largest December decrease since at least 1998

-

there were 51,470 jobs in the private sector. This was an annual decrease of 1,790 jobs (3.4%), its largest recorded decrease in December

-

there were 8,530 jobs in the public sector. This was an annual increase of 400 jobs (4.9%)

At a sectoral level:

-

seven sectors saw annual decreases in jobs; the largest decrease was of 1,040 jobs in hotels, restaurants and bars, which was the second-largest change recorded in any sector to date (with the largest being the annual decrease of 1,700 recorded by this sector in June 2020)

-

the annual increase of 400 jobs in the public sector was driven by an increase of 330 in the number of Government of Jersey (GOJ) core employees (permanent and fixed term employees), which includes staff employed in response to the COVID-19 pandemic

Source: Government Jersey website (December Labour Market Report Published (gov.je))

Offshore Payroll strengthens team with new appointment

Offshore Payroll is delighted to welcome Jackie Helks, who joins the team as a Client Experience Officer.

Jackie together with Offshore Payroll’s Relationship Manager, will have responsibility for further developing effective relationships with clients. This appointment is part of Offshore Payroll’s expansion to satisfy our growing client base. She brings a wealth of customer service experience, having spent over ten years in the luxury hospitality sector, which included responsibility for employee rotas and payroll.

Her passion for client relations makes her ideally suited to support Offshore Payroll clients. Jackie’s expertise will further strengthen Offshore Payroll’s focus on making payroll as simple and efficient as possible for their clients in Jersey, Guernsey and Isle of Man.

Jackie expressed how much she is looking forward to applying her experience in her new role: “Joining the team at Offshore Payroll feels like a natural step after my previous experience in client-facing roles.

I’m delighted to have the responsibility to help create a seamless customer journey and I’m looking forward to working with the Offshore Payroll team, and establishing meaningful connections with our clients.”

Commenting on the appointment, Jeralie Pallot Director, Offshore Payroll, said: “We are delighted that Jackie is joining us as a new member of the Offshore Payroll team. Her enthusiasm and commitment to creating a seamless, enjoyable journey for clients along with her passion for the digital sector, make Jackie the ideal fit for our business. At a time when we are seeing significant growth and change within the payroll market, we know our clients will all benefit from working with her.”

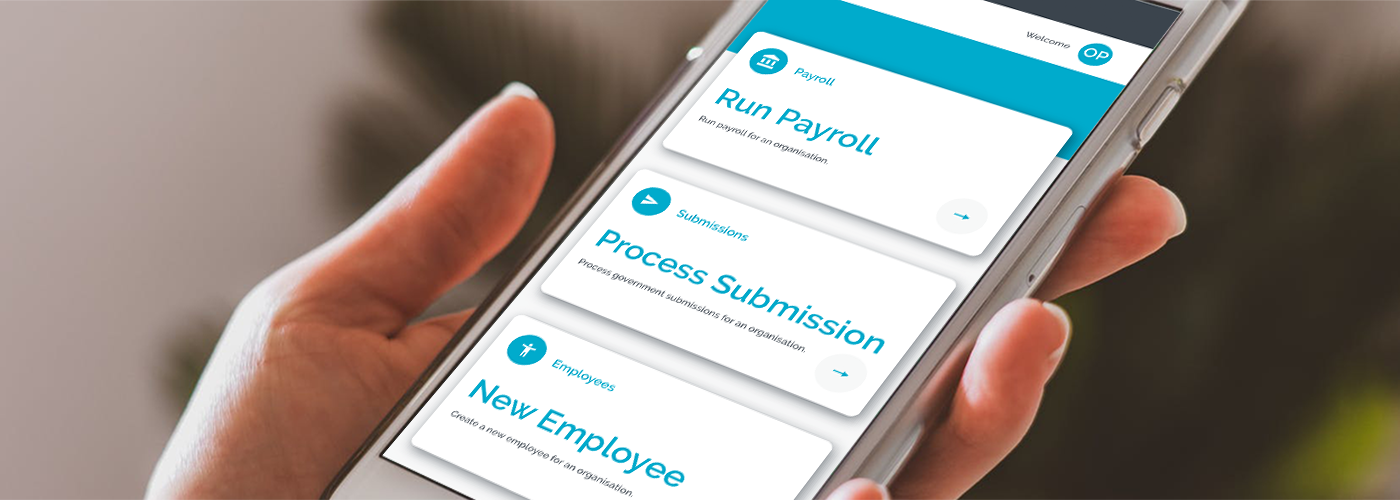

Innovation That Drives Business Success

Staying competitive isn’t just about following industry trends – it’s about leading them. At Offshore Payroll, we recognise that every business has unique needs, which is why we offer more than just standard payroll solutions. Our cutting-edge payroll software is designed to streamline operations and empower your business. For those requiring a customised approach, our bespoke development services ensure your payroll system is perfectly tailored to your specific requirements.

“Can delegate tasks much easier”

What makes our product/service stand out compared to others you’ve tried? The ease of use, we can delegate tasks more easily being cloud based and the good customer service.

Judith Blackford FMAAT AATQB – Business Support Manager