Why cloud-based payroll protects your business resilience

Business preparedness, emergency and continuity are all subjects that most business owners have discussed during their annual strategy days. Fortunately, most have never had to implement these plans – until March 2020.

We all know that COVID-19 pandemic has changed the world of work forever. Homeworking, changes to contracts, government benefits and employee furloughs have all had to be considered and managed.

Perhaps understandably, limitations to our existing HR and payroll have been revealed. Many organisations had to review how they manage their payroll, for the well-being of their teams and their businesses.

Payroll has been tested like never before

Old, complicated, IT systems and ineffective, manual processes have been unable to cope with the ‘new normal’. Inaccurate data and a lack of analytics and visibility have hampered businesses’ ability to make fast decisions at the most critical time.

With often whole workforces based at home, companies have had to urgently manage both the logistical and emotional challenges of keeping teams operational and happy. These issues don’t even take into consideration the potential of higher levels of sickness, leaving many businesses’ shorthanded, at the same time as possibly being over-staffed – it’s often one or the other, but rarely both.

Through all of this, people have still needed to be paid. Often with new, different terms than before as organisations rapidly restructured to maintain resilience.

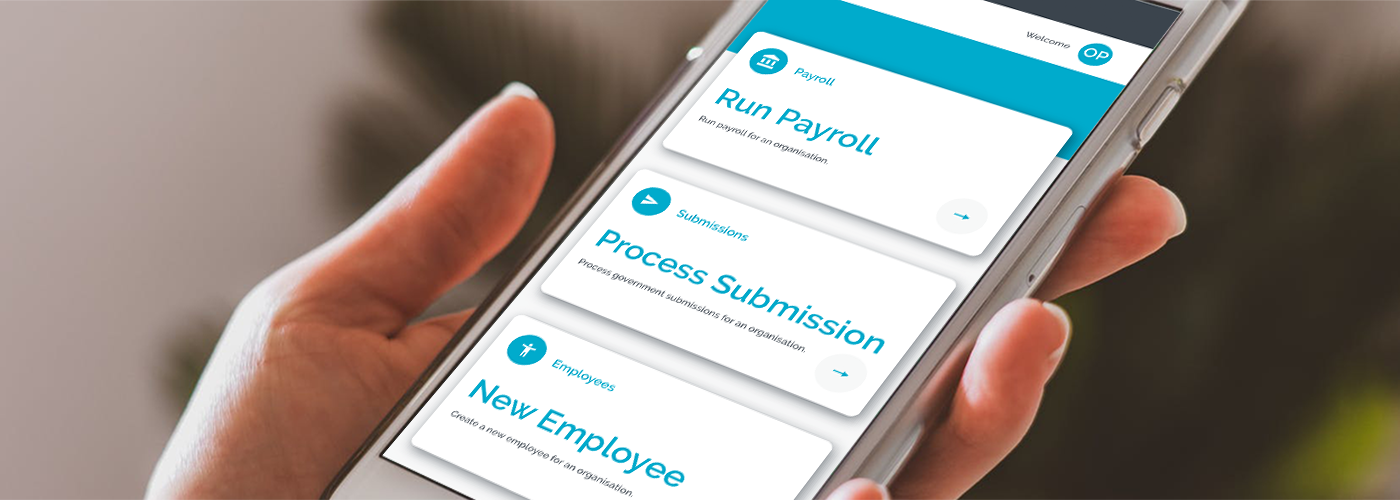

Payroll management needs to be cloud-based

It has become apparent, very quickly, that the organisations who were able to adapt best to these new challenges were those who had embraced cloud-based working. Their teams were able to work from home more efficiently, and the administrative functions of their business, such as HR and payroll, were able to continue seamlessly.

Businesses that had traditional, in-house infrastructure, hosting internally, have struggled, at a time when certainty of income is all important. Having on-premise systems, tied to physical infrastructure and fixed locations, can create security, scalability and in the event of a pandemic even possibly health risks.

Payroll must change forever – like everything else

The COVID-19 pandemic has forced rapid change to the way we work, collaborate and manage our teams. It has also quickly proven that people can work well from home. Even when the health crisis ends, home working won’t, which means that innovations to our HR policies and processes, including payroll will continue to be a worthwhile and valuable investment.

If you would like to discuss how Offshore Payroll could help your business, please email info@offshorepayroll.com to arrange a chat.

September 18, 2024

Related articles

Innovation That Drives Business Success

Staying competitive isn’t just about following industry trends – it’s about leading them. At Offshore Payroll, we recognise that every business has unique needs, which is why we offer more than just standard payroll solutions. Our cutting-edge payroll software is designed to streamline operations and empower your business. For those requiring a customised approach, our bespoke development services ensure your payroll system is perfectly tailored to your specific requirements.

Offshore Payroll strengthens team with new appointment

Offshore Payroll is delighted to welcome Jackie Helks, who joins the team as a Client Experience Officer.

Jackie together with Offshore Payroll’s Relationship Manager, will have responsibility for further developing effective relationships with clients. This appointment is part of Offshore Payroll’s expansion to satisfy our growing client base. She brings a wealth of customer service experience, having spent over ten years in the luxury hospitality sector, which included responsibility for employee rotas and payroll.

Her passion for client relations makes her ideally suited to support Offshore Payroll clients. Jackie’s expertise will further strengthen Offshore Payroll’s focus on making payroll as simple and efficient as possible for their clients in Jersey, Guernsey and Isle of Man.

Jackie expressed how much she is looking forward to applying her experience in her new role: “Joining the team at Offshore Payroll feels like a natural step after my previous experience in client-facing roles.

I’m delighted to have the responsibility to help create a seamless customer journey and I’m looking forward to working with the Offshore Payroll team, and establishing meaningful connections with our clients.”

Commenting on the appointment, Jeralie Pallot Director, Offshore Payroll, said: “We are delighted that Jackie is joining us as a new member of the Offshore Payroll team. Her enthusiasm and commitment to creating a seamless, enjoyable journey for clients along with her passion for the digital sector, make Jackie the ideal fit for our business. At a time when we are seeing significant growth and change within the payroll market, we know our clients will all benefit from working with her.”

Meet our Team – Luke Smith

Luke is a Chartered Accountant who began his journey with the Big-4 firm KPMG before taking the lead in developing Purpose, an award-winning accountancy business based in Jersey. Luke is now Managing Director of Offshore Payroll and a Partner in a successful, boutique Private Equity firm that has created a portfolio of local high performing, synergistic, professional services businesses across industry sectors. With over 24 years’ experience in accounting, finance, and business evolution Luke acts as an advisor to the boards of over 30 owner-managed businesses in Jersey with turnovers of £1M

In 2019, Luke spotted a unique opportunity and led the acquisition of Offshore Payroll Limited, determined to assemble a dynamic team that could take the company’s growth and technological capabilities to the next level. His passion for innovation drives him to continuously explore new ways to leverage technology, to streamline and add value to businesses.

“There’s no other decent cloud solution currently on the market locally”

The response time for any queries during onboarding has been fantastic; we have never had to wait for an answer to our often-daft questions.

Tim Chilestone – Managing Director